CLIENT SUCCESS AND TESTIMONIALS

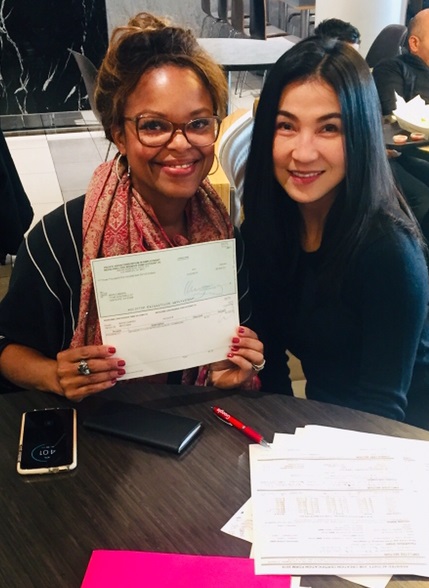

Chef Evi Catering & Events, LLC

Evi Yeh, head chef and owner of Chef Evi Catering & Events LLC. (Photo Credit: Evi Yeh)

PACE helped Chef Evi Catering & Events LLC, a woman-owned business impacted by the entertainment strike in Los Angeles, secure a $10,000 grant to sustain her business and retain workers.

Chef Evi Catering has weathered the storm of the pandemic and entertainment industry strike, and the business is striving. Evi Yeh, head chef and owner of Chef Evi Catering & Events LLC, recently received a grant of $10,000 from the California Restaurant Foundation Resilience Fund that helped the business stay open and retain workers.

“The current economic climate in Los Angeles for small businesses, especially those vulnerable to shifts in the entertainment industry, impacted many businesses like mine starting with COVID and continued to drown us throughout the strikes due to the lack of industry events. Many of us were shut down or had to take every opportunity on, regardless of the rates, to stay afloat and keep our teams employed,” Evi said.

Evi contacted the Hollywood BusinessSource Center to seek access to capital counseling. Her business has been impacted by the Hollywood strikes for several months, and most of her bookings were canceled or postponed. Business/Loan Counselor Elaine Pang knew about a grant that was meant for catering and food businesses and urged Evi to apply.

“When Elaine reached out to us with the opportunity to apply for this grant, we thought it was a long shot, but we’re willing to take a chance on anything. When we learned we had won it, it was life-changing in many ways,” Evi said.

Besides catering for weddings, a 500-person industry event, and family or birthday parties, Evi also does private cooking for a date night. The grant came just in time for Evi, and now she can purchase new equipment that makes the operation flow more smoothly. “…Knowing our doors would be able to stay open, and lights would remain on, the emotional rollercoaster ride I had been on trying to ensure fair wages for my team members, whom I consider like family, finally became more bearable. We are so thankful for all the help we’ve been given and look forward to continuing our efforts toward making the world a happier place, one tummy at a time,“ Evi said.

Traditional Guilin Noodle

It was our privilege working with the SBA office and PACE after the unexpected mass shooting in the City of Monterey Park during the Lunar New Year celebration of 2023, which affected many small business owners within a couple blocks radius of the incident including our business, the Traditional Guilin Noodle. Since then, we have been working closely with PACE to brainstorm how our business stays afloat and apply for grant opportunities. Since then, our business has been awarded a $5,000 grant from the SoCal Gas Restaurant Care Foundation, in addition to $20,000 from the LA County Economic Opportunity Grant for small businesses.

With the continued support of PACE, our business is recovering slowly. Currently, we are experiencing a plateau in growth, but it is sustainable considering the current economic climate. Thanks to the grants, we have enough capital to weather another year, maybe two at current averages. However, we are hopeful that we can reach beyond and achieve stability without external financing—that’s our present goal, at least. With PACE’s connection, we got invited to the White House to celebrate the Lunar New Year event in late January 2024 and the opportunity to meet our Vice President Kamala Harris and our Congresswoman Judy Chu.

I would like to express my deepest gratitude to Congresswoman Judy Chu for her recommendation and to the Office of Vice President Kamala Harris for the invitation to this year’s 2024 Lunar New Year celebration. It was an honor and a privilege to celebrate the Year of the Dragon with fellow Asian community leaders and small business owners alongside members of the AAPI Power Fund and congressional leaders in the home and presence of Vice President Harris and Second Gentleman Mr. Emhoff.

Together, we discussed and celebrated our AAPI heritage, bonding over our similar yet unique upbringings that helped shape who we are today. It was a surreal experience—one that inspires and cultivates a sense of unity and pride in the company of such wonderful people.

The morning after the Lunar New Year celebration, we were invited to the AANHPI Small Business and Community Leaders Briefing hosted by the Office of the Vice President. The meeting detailed an abundance of available resources through the Small Business Administration and its many subsidiary programs and grants focused on supporting and helping small businesses succeed. We want to help spread the word and connect business owners with the resources at the SBA to create a more prosperous Year of the Dragon for all.

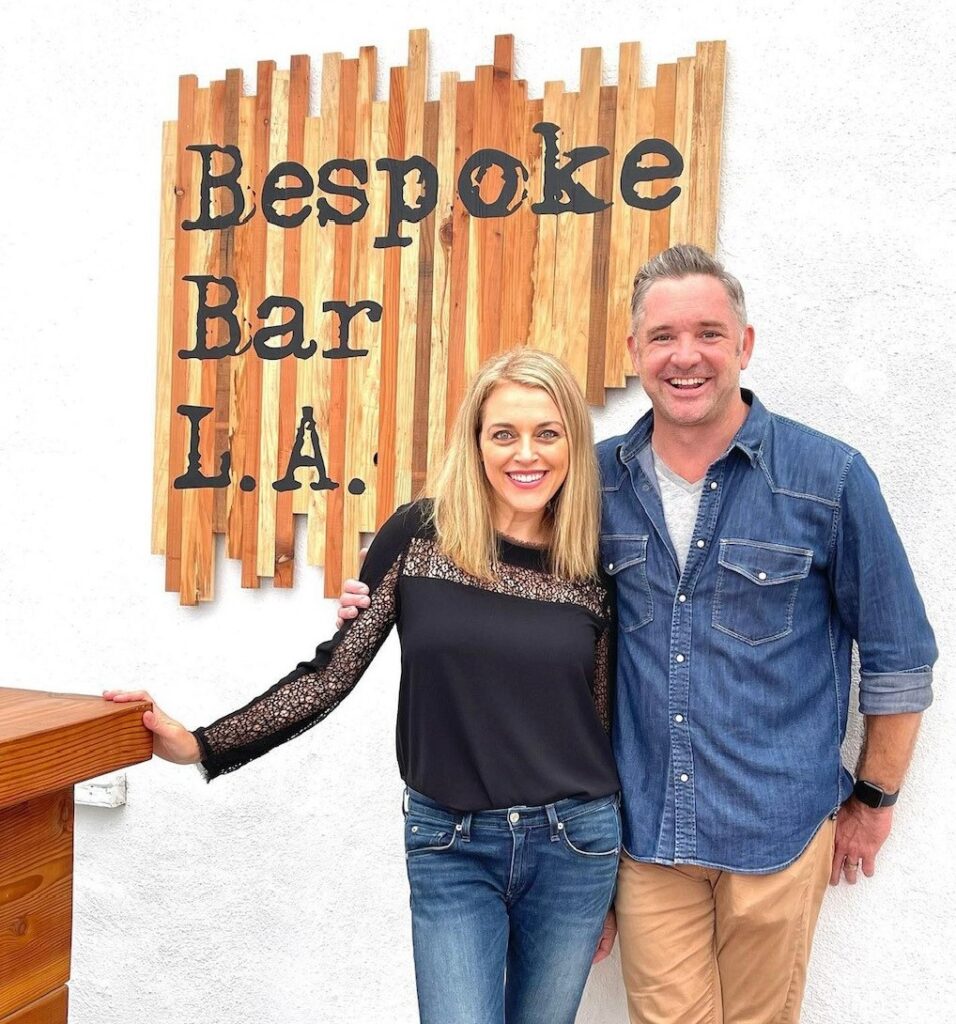

Bespoke Bar LA

BeSpoke Bar opens storefront thanks to Hollywood BusinessSource Center

The Hollywood BusinessSource Center assisted Keren Muller in securing a loan that allows her to open a new storefront Bespoke Bar L.A (https://www.bespokebarla.com/). The business is a unique concept of a “Bar in a Box,” a cocktail company where you can have a curated box of alcoholic beverages filled with the perfect blend of spirits, wines, and beer delivered right to your door. It is located at 2677 S La Cienega Blvd, Los Angeles 90034 in LA’s West Adams – Baldwin Hills – Leimert art district neighborhood in council district 10.

When the husband-wife duo, Keren and her husband Jeffrey Muller, first started their business with this new location, it was a heavy toll for them to pay for rent, expenses, permits, licenses, fees, the build-out of the new store as well as purchasing initial inventory, all while waiting for their ABC license and other permits. In seeking assistance for her businesses, Keren consulted with PACE’s business consultant Diana Chung from Hollywood BusinessSource Center, who provided guidance on finding the right lender and preparing for financing. Diana also advised the couple on the essential prerequisites for obtaining loans and fundamentals to access capital. Following the consultation with Diana, Keren and Jeff received a substantial loan to launch their store. Today, Keren is still working with Diana to develop a robust brand and increase sales through various marketing channels. The couple is excited to continue their entrepreneurial journey and grateful for the resources available through Hollywood BusinessSource Center team to help grow their business.

Be Bright Coffee

Minority-owned Business in Los Angeles Received $50,000 Working Capital Loan to Open First Brick-n-Mortar Coffee Shop on Melrose

Perseverance and determination are best described by the founder and owner of Be Bright Coffee, Frank La. He never gave up on his entrepreneurial dream of opening a cafe. With Hollywood BSC assistance and PACE (Pacific Asian Consortium in Employment) working capital loan, he opened his first brick-n-mortar café in the heart of Los Angeles in Oct 2022.

“Access to capital is very important to startups like us. The biggest ticket item is storefront renovation expense. With the loan, we can purchase a new countertop and it brings a clean and refreshing look to the store,” La said.

To bring a new look and cut costs, La and his family rolled up their sleeves and painted the interior and facade into a more vibrant and brighter color; the ambient feels very refreshing and welcoming. Starting as a small vendor at Smorgasburg in 2021, Frank worked with his family selling specialty coffee and providing coffee catering service to corporate events. Be Bright Coffee started building up the brand recognition, production capacity, and gaining exposure.

Due to high customers demand, La wanted to take his business to the next level and reached out to PACE for guidance. He didn’t qualify for a loan when he came to the lender two years ago, but he didn’t give up. He took advice from the PACE business development center and started building the brand small. He built the e-commerce platform and tested the market and then slowly moved to Smorgasburg and participated in community events. Two years later, after his dedication and hard work, La made his dream come true by opening his own storefront in the Hollywood area.

Congratulations to Frank La, owner of Be Bright Coffee, for winning the 2024 U.S. Barista Championship. We are so proud of him for reaching this milestone since receiving small business assistance from the BusinessSource Center – Hollywood Region.

New York Cake Pops

New York Cake Pops is making dream come true again in Los Angeles with Pico-Union/Westlake LABSC

With the guidance of Pico-Union/Westlake LABSC, New York Cake Pops, based in the East Coast, has expanded their presence into the Los Angeles Area.

The local business, New York Cake Pops LA LLC is owned by Lerida Mojica and Robert Rodriguez. Lerida first came to the US from Mexico in 2003 and met her husband, Robert, in the same year. She first began making cake pops for her children’s birthday parties and immediately noticed the outpouring of requests and positive feedback from friends and family.

Seeing this as an opportunity, she began to branch out and started catering for company parties in 2009. NY Cake Pops was an immediate hit and thus began her growth with corporate accounts. These accounts spread over the United States, and the next logical step was to expand into Los Angeles with a retail operation.

In Los Angeles, they first began their process of opening up a shop by obtaining a former dry-cleaning business. Lerida and Robert approached PACE to help secure capital that would go towards the establishment of their flagship retail location. With Pico-Union/Westlake LABSC’s assistance, New York Cake Pops was able to secure a $200,000 loan and additional funds in grants to help complete the renovations of their new location at 7306 Beverly Blvd, Los Angeles, CA 90036.

Brown Bag Cookies

PACE helps dreams come true with financial counseling and practical assistance, securing $50,000 from SBA Micro Loan.

Mr. Hyung Chul Kim is the owner and the main pâtissier of a newly established dessert shop in the heart of Los Angeles called Brown Bag Cookies. Graduating from a culinary school of arts and moving to Los Angeles about ten years ago, he always dreamt of having his own restaurant, but he did not feel quite ready to turn his dream into a reality. Amid the COVID 19 pandemic, he finally decided to take a bold step when he got fired from his job as a restaurant manager. He actively looked for financial help to start his business, but he had difficulty getting a traditional business loan without proper paperwork. He decided to consult SBA directly, where he was introduced to Pacific Asian Consortium in Employment (PACE) Finance Corporation, an SBA lender, and Pico-Union/Westlake BusinessSource Center (BSC).

When Mr. Kim contacted Pico Union/Westlake BSC, he had a specific goal in his mind to open his new business. His business counselors assisted Mr. Kim in setting a professional and collaborative plan that evaluates, implements, coordinates, and monitors the options and services to meet the client’s goal. This one-on-one counseling service was instrumental in promoting a better financial understanding for Mr. Kim’s needs. Pico Union/Westlake BSC counselors provided step-by-step assistance in creating a comprehensive business plan and building his financial records to increase his financial capability. Mr. Kim was also able to obtain the business permits and licenses required by the City of Los Angeles and his Fictitious Business Name Statement. After spending about three months in the preparation stage, Mr. Kim successfully applied for an SBA microloan with PACE Finance Corporation and was approved.

Finally, after spending about three months together with the Pico Union/Westlake BSC Loan Coach in preparation for the loan documents, Mr. Kim successfully received his SBA microloan for $50,000. With this, Mr. Kim secured a lease contract for his business location, completed his tenant improvement with the loan proceeds, and purchased his baking equipment with his own capital. Most importantly, Mr. Kim was finally able to accomplish his lifelong dream of having his own shop. By taking a few financial webinar courses provided by Pico Union/Westlake BSC, Mr. Kim can now forge a pathway towards having a successful business plan for the upcoming years.

When skills and motivations were not the only ingredients needed for Mr. Kim’s start-up, Pico Union/Westlake BSC in partnership with PACE Finance Corporation provided financial assistance, enabling Mr. Kim to purchase his equipment and lease a business location. Running his own business allowed him to spend more quality time with his family on weekends who continued to support him through this journey, and he didn’t have to work at night anymore.

Currently, Pico Union/Westlake BSC is assisting Mr. Kim in completing the CA Office of the Small Business Advocate’s (OSBA) CA Dream Fund grant program, which provides a microgrant of up to $10,000 to new entrepreneurs. The extended coaching, hiring assistance, and financial monitoring will form the structure that will ultimately lead to Mr. Kim hiring his first employee, opening his second location, and contribute to his successful journey as a small business owner.

EWDD’s BusinessSource Centers offer a variety of Business Services, including several Financial and Development Incentive Programs and a Small Business Loan Program. Learn how EWDD can help your business grow and succeed.

Ling Ling BBQ

First Generation Asian American Women-owned Business in Chinatown Received $5,000 from Comeback Check Program Grant help Business Sustain & Created Jobs

First generation Asian American restaurant owner CuiLing Qiu operated Ling Ling BBQ Fast Food on Ord Street in Chinatown since 2019. Operated for only three months and COVID-19 hit, Qiu’s restaurant was forced to stop in-door dinning service and offer to-go / delivery only to her customers. In early May, the Hollywood BusinessSource Center assisted Qiu to secure a $5,000 small business grant that helped her to sustain the business.

Qiu was very happy that the City launched the Comeback Check Program. Due to language barrier, limited technology resources and knowledge of the program, she turned to Hollywood BusinessSource Center for help. “My first language is Chinese Cantonese and I am not tech savvy. When I saw the email from the city, I thought it was another junk email. That’s why I reached out to Elaine who can provides in-language technical assistance and can help me apply for the grant” Qiu said.

Elaine assisted Qiu to filled out the online application. Once Qiu was being selected as grantee, Elaine helped Qiu gathered all supporting documents, such as photo ID, past tax returns, business license and uploaded to the Spark portal.

Qiu received the $5,000 grant in early May. She was able to sustain the business, retain two employees and hire two additional part-time employees with the grant.

Noyon Corporation Sushi

For over a decade, Lilly Jiimen and her husband owned and operated a local sushi restaurant, Noyon Corporation Sushi in the City of Los Angeles. Things were going well, and the business grew steadily. In March 2020, all this changed when the entire State of CA was under a Safer at Home order and small businesses had to close due to the Covid-19 pandemic. Lilly knew she needed desperate help as expenses grew, but revenue had been halted. She reached out to the PACE Women’s Business Center (PACE WBC) to help apply forCOVID-19 business resources and any financial assistance that may help her sustain her family-own restaurant. She connected with Swann Do, Director of PACE WBC.

During their initial meeting, Lilly shared that her business is slow due to Covid-19, but she continued to pay their employees. She used her retirement account to supplement the business expenses and it was depleting quickly. Prior to the COVID-19 pandemic, her sushi restaurant employed a total of 10 employees. However, during the pandemic and with no incoming cash flow, they were forced to cut her staff to less than half and their duties were shifted to now taking phone orders for pick up and delivering foods to customers.

Swann assisted Lilly to apply for the loans program available to help small businesses during this time, the SBA Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP)loan. After applying in March 2020, Swann helped follow upon the application. Unfortunately, there was no record of the application due to the overwhelming application response. However, the SBA phone agent was so helpful and assisted with the process again. Lilly had to submit additional information and within two days, her application got reinstated to the SBA system. Lilly was able to receive $8,000 in advance through the SBA EIDL on April 2020. Ogi shared with Swann, “Ms. Swann, I received this SBA$8,000 notice yesterday and it went through to my account today. Something magical happened!”

This was only the beginning and Swann worked with Lilly to apply for additional assistance. Lilly indicated that she had applied for the SBA PPP before through her primary bank Wells Fargo bank, but she did not hear back. She was very concerned that the PPP funding might be depleted and asked if Swann could assist her to apply through PACE. Lilly was willing to accept a lower loan amount even though she qualified for more. While reviewing Ogi’s files and getting them ready for another funding program, Swann got a call from Ms. Jiimen.

She shared that Wells Fargo just funded her PPP loan for an amount of $56,486 on May 2020: “I saw PPP money went through. Just wanted to say thank you. I feel like I won the lottery!”

Since she received her initial PPP loan, Lilly brought back her entire staff. Swann and Lilly still meet frequently to discuss any new updates regarding operating a business during Covid-19. When the 2nd round of PPP funding became available, Swann reached out to Lilly to inform the client that the 2nd round PPP is now available.

Client wished to move forward with the 2nd round PPP loan through PACE. Lilly Jiimen found it easier to work with PACE and the application was completed quicker. Lilly received her 2nd PPP loan through PACE in Jan 2021 for $79K. With this capital injection, Lilly retained all 10 of her staff and PACE WBC was able to save another business from shutting down.

While assisting with financing, Swann also introduced Lilly to the PACE WBC procurement process. Swann connected Lilly to Andrew Barrera, PACE Procurement Manager, and they began working together. He assisted the Noyon Corporation to better understand the procurement process and help them further develop their business infrastructure to more actively compete for contract opportunities. This includes: identifying what Small Business Certifications they should apply for, registering their business on numerous government and private sector Supplier Vendor Portals and to start contract sourcing.

The Cookie Dip Company

In September 2021, Ms. Zakiya Ellick came to PACE seeking business development assistance for her newly established Cookie Dips business. Specifically, Ms. Ellick needed help with accounting and budgeting; cash flow management; marketing and sales; and legal services to help trademark her logo. Her primary goal was to learn how to manage and expand her Cookie Dips business. Cookie Dips is an organic dipping cream packed with extra flavors for cookie lovers of all walks of life. It is also a way to introduce fruits to kids as it is made with varies fresh fruits.

In 2017, her circle of friends are very competitive cooks with each other. Zakiya and her friends were invited to prepare appetizers for the Playboy Jazz Festival. After finishing cooking and gathering all the food, she suddenly realized that they didn’t have anything sweet to offer jazz festival guests. Ms. Ellick quickly put together her Cookie Dips ingredients in a bowl and proceeded to make Vanilla Bean and Lemon cookie dips. She shared them with her friends while at the festival. They raved about the bold, decadent flavors. Ms. Ellick then began sharing her Cookie Dips with neighbors and received the same response. It was at that moment that she realized her Cookie Dips should be shared with the world!

To date, Ms. Ellick has a total of 16 different flavors of Cookie Dips to offer cookie lovers everywhere. The key elements that set The Cookie Dip Company apart from other companies are her innovative, flavor bursting premium combinations, such as Mango Chili, Milk Chocolate Horchata, Banana Cream, and Butter Toffee Bourbon. The Cookie Dip Company is the snack you never knew you needed!

Ms. Ellick’s business has grown by 75% of her original investment since 2021 servicing over 500+ clients in search of her in-demand cookie dips. She is currently selling to a division of Door Dash and Dash Mart. Both companies are currently carrying her 2 top selling flavors, with distribution throughout Los Angeles County, San Bernardino, Ontario, Los Gatos and San Diego County. Ms. Ellick is currently working on partnering with Amazon Prime, and further down the line would love to partner with Ben and Jerry’s. You can find her products at Pop-up shops throughout Los Angeles County and online.

Ms. Ellick is currently getting ready to enter the Procurement world to obtain bids for government contracts. After PACE assisted her with building her capability statement and obtaining her minority certifications, she is now working with the Procurement team at PACE to learn how to bid for those contracts. She has also reached out to Trade Associations for suppliers to the food processing and packaging industry and is connecting with distributors, and a private label cold packer/manufacturer.

Zakiya is proud of the evolution of her products & the local notoriety her brand gets from word of mouth. She is proud that she is able to provide jobs within her community. Her greatest accomplishment to-date was catering Stevie Wonder’s daughter’s 5th birthday party. Never in her wildest dreams did Ms. Ellick find herself in the presence of the great Stevie Wonder. She is proud of the relationships she has cultivated with local radio stations such as 93.9 FM, KJLH, Power 106 FM, 93.5 FM, & KBLA FM and The Tavis Smiley network. Ms. Ellick is honored to have been a guest at the Emmys’ and Oscars’ gift suites, Long Beach Pride, Taste of Soul LA, and ComeUp LA.

Through the continued growth and development of her business through the procurement bidding process and other branding and marketing opportunities, Ms. Ellick looks forward to more such prospects.

Tamashii Ramen House

MidCity BusinessSource Helps Local Ramen Business to Acquire $735,834 in Funding and Create/Retain 22 Jobs throughout the Pandemic

Throughout the pandemic, the Mid-City BusinessSource Center has been guiding and helping a long-time client Colin Fung to acquire an overall $735,834 in funding from different disaster loans and grants to sustain his local restaurant business. He utilized part of the fund to rehire a total of 22 employees across his three Tamashii Ramen House restaurants in North Hollywood, Sherman Oaks, and Studio City.

Colin and his family emigrated from Hong Kong to Los Angeles in 2011, he embraced the ambition of creating an eatery serving freshly made healthy and tasty ramen in Sherman Oaks in 2012. Thereafter, Colin expanded 2 more ramen restaurants in North Hollywood and Studio City with the application assistance provided by PACE Business Counseling Manager Wai Ling Chin. Colin successfully obtained 3 business loans in a total of $105,000 for his working capital to grow his business. Tamashii Ramen House was awarded the “2015 Outstanding Small Business” from Los Angeles Mayor Eric Garcetti as his restaurants created more than 40 jobs.

Due to the impacts of COVID-19, his restaurant business was deteriorating since February 2020. The Studio City location was closed followed by the Sherman Oaks location. Only North Hollywood remained open for take-out orders during the outbreak. Soon after, Wai Ling assisted Colin by providing him adequate guidance and information for applying different disaster loan programs such as the Paycheck Protection Program (PPP), Economic Injury Disaster Loan (EIDL), and EWDD emergency loans. She assessed his business eligibility to help him apply for the loans and connected him with the right banker. As a result, Colin obtained $135,332 from the first PPP loan, $20,000 EWDD loan, $150,000 SBA EIDL loan, and $10,000 SBA EIDL advance loan to maintain his business operation and rehire 18 employees during the challenging time in 2020.

Wai-Ling also shared all available resources with Colin such as the Al Fresco outdoor dining opportunity. Fortunately, the Noho district granted his restaurant to use the sidewalk and part of the street for al fresco dining and the Sherman Oaks restaurant management granted him the parking lot for outdoor dining. Wai-Ling also introduced him to Brown & Brown Quality Care, a center that provides local services that promote equality, dignity, and independence for adults with disabilities, Colin provided job training opportunities to 2 of their trainees.

When the second round of PPP loans began, Wai-Ling assisted Colin with the PPP second draw assessment, application form, borrower certificate, and preparing all necessary supporting documents. In the beginning, Colin was not able to have his PPP application processed through the Bank of America’s portal after several unsuccessful attempts. Then Colin decided to apply for the second PPP loan through PACE Finance Corporation with Wai-Ling’s technical support and submitted his application to PACE’s lending department. In March 2021, Colin’s second PPP loan of $170,502 was finally approved and funded. In addition, Wai-Ling guided Colin through the application process of the Restaurant Revitalization Fund (RRF) program, Colin’s RRF application was approved for $250,000 in June 2021. With the second PPP loan and RRF fund, Colin hired 4 more new employees during the pandemic.

Colin is very blessed and thankful for the supportive services and resources provided by the Mid-City BusinessSource Center and Wai Ling. As an immigrant entrepreneur, he evolved his business and overcame many obstacles with the help of the BusinessSource over the years whether they were ups and downs. The support that he received is definitely life-changing, saving his business and workers!

Ohana BBQ

PACE Mid-City Business Source Center helped facilitate a long-time Korean-Hawaiian restaurant, Ohana BBQ, to acquire $224,000 in various disaster loan programs to save six of their employees. With all the supportive resources and effective planning offered, Ohana BBQ can survive and thrive in this critical climate during COVID-19.

Young Yoo emigrated from Korea to the United States in 1980. In 2005, he purchased the Korean-Hawaiian restaurant business “Ohana BBQ” located in Studio City and has been operating the restaurant for 16 years. As a result of years of tireless effort and methodical management, his small business was able to generate decent earnings with the excellent local community and customer reviews. During the peak of the pandemic, Ohana BBQ’s revenue dropped dramatically in March and April this year. His business fell into a harsh financial situation all of a sudden, but he was still paying salaries for his 6 employees without making any business revenue.

In March 2020, Young was referred by the Southern California Korean Restaurant Association Group to PACE Mid-City Business Source Center. He was assisted by Diana Chung, a MidCity Business Source Counselor, who was able to provide free 1 on 1 business counseling with Korean language assistance. Diana helped analyze his business’s profile, discussed different types of available disaster loan programs, explained the loan applications’ procedures and usages, and guided him to prepare all required loan documents. She also assisted in writing his business project budget and financial statement, and translating any relevant emails throughout the application process. Moreover, Diana advised him on the CDC and OSHA re-opening business safety guidelines and new system.

Despite all the assistance provided, there were some challenges along the way. For instance, technical issues that occurred on the application website and being unable to submit the PPP loan application through the banks that his business has an account with. With Diana’s guidance, he was able to get a $48,000 PPP loan funded from PayPal. He also successfully secured $156,000 from SBA EIDL and $20,000 from the EWDD emergency loan, totaling $224,000 loan funds for financing and sustaining his business.

Young is utilizing the loans for working capital including rent, utilities, and employee payroll to retain 6 employees and keep the business operating. Ohana BBQ is currently offering outside seating, delivery, and take out options. He ensures that everything is completely meeting the safety guideline standards at his restaurant. His business is generating consistent sales, the majority of the business revenue came from to-go orders.

Young is very glad that PACE Korean speaking Business Counselor Diana was able to help his business overcome the arduous challenges when he had some language barrier and lack of financing information during this crisis.

Martinez Fresh Fruit ~ Fruitas Frescas

The Business Source Central West region has developed a long-term local client Mr. Nicolas Martinez, a Los Angeles sidewalk vending business owner. Mr. Martinez, an uneducated immigrant who is in the process of legal US citizenship, started his sidewalk vending business 10 years ago because of his brother. Until the recent 2019 legalization of sidewalk vending Nicolas willingly paid tickets and was even arrested and jailed from trying to maintain a business to provide for his family. The Department of Public Health had also informed him that he would need a food cart which he overcame by saving over $5,000 to eventually purchase an approved cart, which was a difficult task for him being low-income. As soon as sidewalk vending became legal he wanted to apply for his permit. Referred by StreetsLA to PACE Business Development Center, Nicolas was provided a sidewalk vending orientation with direct assistance from Ms. Veronica Lopez, a PACE counselor who assisted him with the permit application process. Because Nicolas was still in the process of his Visa he could not acquire his ITIN. With the help of Veronica and the PACE Vita Program, Nicolas was able to process his ITIN request and submit it to the IRS, however due to COVID-19 and the tax season he had to wait 6-months for his official number. After attaining his ITIN in the mail he revisited Veronica Lopez at PACE BDC who then helped him apply for the BTRC, Seller’s Permit and in completing the city sidewalk vending application he was finally able to get his permit the same day. Nicolas is now successfully running a city approved legal vending business.

Nicolas runs his city vending cart business as Martinez Fresh Fruit from the One Stop Commissary located at 459 E. 4th Street, Los Angeles CA 90013. Nicolas is a passionate hard working 10 year business owner who expressed relief to his PACE counselor “I have peace now because me and my friends can sell legally and we won’t be bothered by police.” Nicolas refers to himself and his friends (mostly other family members) who work together as a group of independent vendors at favorite city locations. EWDD’s BusinessSource Centers offer a variety of Business Services, including several Financial and Development Incentive Programs and a Small Business Loan Program. Learn how EWDD can help your business grow and succeed.

Bubles Champagne Catering Service

Following her dreams….. Ms. Maya Entwistle began her journey in the food & beverage industry at Ruth’s Chris Steak. As the event manager she helped host numerous Valley Economic Alliance (VEA) networking events through the restaurant, eventually amassing her own network of potential clients. Little did she know that the VEA would be her resource in finding a loan source that would help professionally launch her business.

In early 2019 Maya took the leap of faith utilizing the experience and knowledge she acquired from many years in the food and beverage services. Her dreamt up concept was an event company called “Bubles Champagne;” “Catering a beautiful champagne bottle station for all occasions.” “A party is not a party unless you hear the pop of a champagne bottle.” Through her event management job she met Jacqui Matsumoto and shared her aspiration of becoming a business owner. Jacqui loved the idea and referred her to Gail Lara with Hope inside Northridge Small Business who offers a 6 weeks program for small business entrepreneurship. Once she graduated from the entrepreneurial training classes in June 2019 she started the process of applying for a loan with the only bank she had for many years only to be unexpectedly turned down due to the fact that her business was not established long enough.

Fortunately, Maya was referred by VEA to Supranee May, a PACE business counselor, to seek access to capital assistance. After meeting in November for an initial financial assessment of her situation, Supranee was able to assist her in applying for a mini microloan through PACE Finance where she was ultimately approved for a $3,500 loan by December 31, 2019. The timely proceeds will help her fund the much needed marketing costs, including professional marketing materials and a website, so she could start promoting her catering service successfully.

Maya Entwistle is forever thankful to PACE business counselor Supranee May, PACE Finance, and the VEA for their encouragement and desire to see her succeed and to allow her to share her story to all new small business entrepreneurs.

Luchador Kambucha

PACE ETP graduate Mr. Daniel Munoz: Family Man, Muay Thai Trainer, Army Veteran, Litigation Paralegal, Small Business Advocate, and new founder/sole-proprietor of a local Los Angeles catering company Luchador Kambucha. Daniel entered the entrepreneurial life to be free from any hostile or oppressive work environment so he can ultimate enjoy his family without bringing home the work related stresses of a typical job. However, it was not an easy path. For many years Daniel worked for a top litigation attorney and worked his way up to becoming a paralegal. He began meeting different small business owners, helping them navigate legal issues often without charge. This led to his inspiration to ultimately find a way to have his own business where he could be his own boss.

Eventually Daniel was referred by a friend to PACE Finance and their ETP Program. Through this program he met Swann Do, Director of PACE’s Women’s Business Center (WBC), where she assisted in his business plan development and eventual low-cost startup. Daniel credits much of his success in getting a small catering business started to the informative entrepreneurship program as well as personal business mentorship from PACE WBC. Daniel has been busy building his catering business with small private party events and has successfully opened up part-time with an outdoor street front patio location in East Los Angeles. With his business steadily growing Daniel hopes to eventually secure a PACE Finance microloan to help with equipment purchases and working capital. His biggest take-away from that first PACE introduction 3 years ago was the need to first clear up his personal life of unpaid parking tickets, unfilled taxes, marriage, family life, etc. Like many people all the burdens of life had overcome his motivation to get any form of business off the ground. Through the PACE business counselors and guest industry experts he gained invaluable business insight that not only saved him tremendous start-up costs, but helped save him invaluable time in launching his catering business.

Tita’s of Manila

Tita’s of Manila Filipino Woman Restauranteur Cielito (Sherrie) Vergara-Divine opened her new West Covina Filipino Restaurant Tita’s of Manila with sister Charita Vergara in early 2019, creating 20 new jobs. Almost one year later with tremendous success, increasing daily revenue over 36%, Sherrie secured a $100,000 SBA 7a community advantage loan for working capital and the completion of property renovations, upgrades and new fixtures and equipment needed for the successful increase in business volume since purchase, and to facilitate continued business growth. Cielito, who is better known as “Sherrie,” successfully started in the food business by participating for many years at the open-air “626 Night Market” located at the iconic Los Angeles County Santa Anita Park in Arcadia.

After numerous successful years operating this 10×20 foot food booth with her sister Charina Vergara (Char), the sister team successfully purchased their existing Filipino restaurant in West Covina. Char Vergara works in day to day operations of the restaurant, while Sherrie, still holding down a full-time job with LAUSD, operates as CEO handling bookkeeping/payroll, human resource compliance, property, and capital resource administration. Their combined history of restaurant experience and operations management has enabled the successful startup of Tita’s of Manila, and with this new loan they anticipate continued revenue growth, staff employment, and creating a better dining experience for growing new business and repeat customers.

Mancora Peruvian Cuisine

Jorge Wong grew up in the restaurant business with his family and came to the U.S. as college student in communication. Over ten years he established himself as a local hispanic radio station DJ representing advertisers specializing in auto sales. His radio DJ exposure made him a well-known personality that also gave him many community connections that also led to years of event planning work with the Beverly Hotel.

Jorge subsequently desired a return to the restaurant business, and with his many community connections and infamous celebrity he launched his first restaurant in 2017, MANCORA PERUVIAN CUISINE. He picked Alhambra for this first location because there was no other Peruvian restaurant around. The Peruvian restaurant was a success and Jorge began to envision bringing his unique cultural restaurant to other locations. With his strong connections in various hispanic markets he found possible demand within the East LA/Monterey Park area; far enough from Alhambra not too compete, but close enough in which he could manage two restaurants. His concerns however were to avoid spreading himself too thin financially, too soon after launching his first restaurant. When a great location in need of a culturally diverse restaurant presented itself with a combination of below market rent and a motivated landlord, Jorge took action. However, he would need financial help as he was still personally burdened with the personal high cost credit card debt used in launching his first restaurant. Turned down by traditional banks due to the high-risk nature of mom and pop restaurants, and without any reasonable investor that would maintain his majority ownership position, this location opportunity seemed likely to go away. Fortunately for Jorge he was referred to PACE Finance by a neighboring business owner who similarly needed an unconventional source of funds for their small business. Jorge worked with Steve Meng, a Pace Finance Loan Counselor, numerous weeks evaluating first location financials and creating reasonable new location revenue projections along with new jobs created. Ultimately, Jorge obtained a PACE Finance $100,000 SBA loan to help refinance some of his high interest credit card debt and secure the needed capital for completing the restaurant build-out including architectural design, permitting, fixtures & equipment, and working capital startup costs. As a result the second location of MANCORA PERUVIAN CUISINE was successfully opened in September 2019 contributing nine new jobs outside of family members, and has been steadily building new and repeat customers. Jorge Wong has been busy overseeing and stabilizing the operations of his two locations but is excited about the future as he is learning how best to scale a successful restaurant business.

Blended Berries

The PACE – BusinessSource Central West Region assisted Lisa Berry in obtain her LA Business Tax Registration Certificate that will allow her business, Blended Berries Tea, to be in compliance.

In November 2017, Lisa started this business to help people live a more natural and healthy lifestyle. Growing up in a low income neighborhood and being the first college graduate, Lisa felt it was her

duty to be an agent of change. She thought she only needed a permit to sell for her business and didn’t know she had to charge sales tax on her products. Many LA entrepreneurs starting out are in a similar situation, being unaware or unfamiliar with all the rules of starting a business.

However, Cathleen Hy, a BSC business coach, was able to offer one-on-one business consulting and help Lisa navigate through the different government websites. Cathleen also clarified to Lisa that when she obtained a Seller Permit, she was suppose to charge the 9.5% Sales Tax on her products. Lisa needed to keep the money on the side so she can pay the taxes to the California Department of Tax and Fee Administration by the end of each quarter. Cathleen was able to help Lisa update the settings on Blended Berries Tea’s website to account for the sales tax. The assistance she received allowed Lisa to keep her Seller’s Permit and continue her business, creating and retaining her job. Lisa will continue working with Cathleen as her business grows and will need financing when the time comes to expand.

Stories like these allow budding entrepreneurs to have confidence in the resources available to help them succeed!

Contact PACE Business Development Center to see if we can help you too!

Buna Ethiopian Market

Helina Zerfu (center) accepting award at Los Angeles Mayor Garcetti’s 3rd Annual Small Business Award Ceremony. Joined by Director of PACE Women’s Business Center, Swann Do (right), and PACE Loan Counselor, Steve Meng (left).

Helina Zerfu immigrated to Los Angeles from Ethiopia in 2004. After many years of working in the restaurant industry, she opened her own restaurant “Buna Ethiopian Market” in 2011. She found that her customers enjoyed the dishes she prepared using family recipes. Though she was a master in preparing these wonderful dishes, Helina realized that she had little knowledge of how to run a business. She came to PACE Women’s Business Center (WBC) looking to increase her business skills.

Helina enrolled in the five week intensive Entrepreneur Training Program (ETP) and learned about how to run a successful business. She completed the program, yet did not stop her training. She continued to meet one-on-one with her mentor, Swann Do, PACE WBC Director. In 2014, PACE helped Helina secure a $21,000 Small Business Administration microloan to upgrade her restaurant’s kitchen equipment.

In March of 2015, Buna Ethiopian Market was recognized in an LA Weekly list of ‘99 Essential Restaurants’ in Los Angeles. This recognition has helped her restaurant stand out from other competitors in her neighborhood and her sales have more than doubled. Helina’s five-year plan now includes creating a more casual family-style menu and opening additional locations in Los Angeles. She contributes much of her success to great mentorship and access to resources with the help of PACE Women’s Business Center.

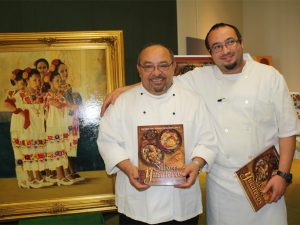

Chichen Itza Restaurant

Chichen Itza Restaurant is a family owned and operated business inside the Mercado la Paloma in south Los Angeles. Established over 15 years ago, the restaurant specializes in Yucatecan food, a mixture of Mayan, Spanish & Lebanese recipes. Chef and owner Gilberto Cetina has been recognized as one of the top Latino chefs in the country and has been written up in publications like GQ Magazine, Hispanic Magazine, Culinary R&B, and LA Weekly, just to name a few. Just last month, Chichen Itza was selected as one of Pulitzer Prize-winning food critic Jonathan Gold’s 101 Best Restaurants. Chef Cetina began working with the Central West BusinessSource Center in early September. He was seeking financing to expand his restaurant and purchase equipment for a new catering kitchen. With assistance from Loan Counselor, Alvaro Bermudez, Chef Cetina applied for an SBA microloan. That same month, Chichen Itza was approved for a $25,000 loan. They plan to have a new kitchen and hire 4 new staff by early 2017.

Open Source Organic Juice Bars

Hollywood, CA Location

Hannes Poelleritzer and Stefan Poelleritzer, owners of the new Open Source Organic Juice Bars in Los Angeles, has worked with the Central West BusinessSource Center for the past year after purchasing it from another business owner. The two brothers are new immigrants to the United States, but had a dream of owning a retail store that sold organic fresh made fruit and vegetable juice.

The Poelleritzers originally came to the center inquiring about obtaining the necessary information to apply for a business loan. They wanted $40,000 to purchase equipment and use the extra funds for working capital for their new store. Their vision was to create easy access for everyone who wanted something healthy and organic. They expanded their business to a juice truck serving the communities around Los Angeles. Their store is located on 7107 W Sunset Blvd, Hollywood CA 90046.

The Wing Fix

An immigrant from Japan, Harumi Kim came to the US as an exchange student. After college, Harumi worked in different industries but eventually found her passion as an entrepreneur. Harumi and her husband went into business with a friend to start a gourmet Asian-fusion chicken wing restaurant, “The Wing Fix”.

When their business partner unexpectedly left, Harumi and her husband were left with managing and operating the business. After struggling for months, she came to PACE. Harumi enrolled in the PACE’s Women’s Business Center in November 2012 and worked with Swann Do. After attending several business development courses, Harumi was able to create a long-term plan for the success of her business. Harumi continues to come to PACE to find ways to expand her business.

Harumi’s business created seven jobs. She even sends her employees, who are now part-owners in the business, to take courses at PACE. Harumi said, “I believe with my whole heart that with passion, focus, and knowledge our dream to go beyond the first store could come true.”

SHARE

Check out the PACE Women’s Business Center and see how we can help you too!